Dbs Fixed Deposit Promotion

Foreign Currency Fixed Deposit. This account provides guaranteed interest returns for up to 11 different currencies including US dollar (USD), Euro (EUR), British pound (GBP), Canadian dollar (CAD), Australian dollar (AUD), Swiss franc (CHF), New Zealand dollar (NZD), Singapore dollar (SGD), Chinese yuan (CNY), Hong Kong dollar (HKD) and Japanese Yen (JPY).

Looking for the best fixed deposits in October 2020 in Singapore? If you have 50K, you should read my previous post on Where Will You Put 50K? before you jump straight into Fixed Deposits.

- If you opt for a short tenure, ICBC may have the best fixed deposit rates in Singapore for you. The bank lets you deposit a minimum of S$500 for 3 months, through which you can earn 1.3% p.a. The best thing about the bank’s offered promotion is that you can earn 2% p.a. With a S$5,000 deposit and above in 1 year.

- The current highest DBS fixed deposit rate of 1.3 per cent p.a. Is considered sky-high by Covid-19 standards. The minimum of $1,000 is is quite a manageable amount, although you have to commit to.

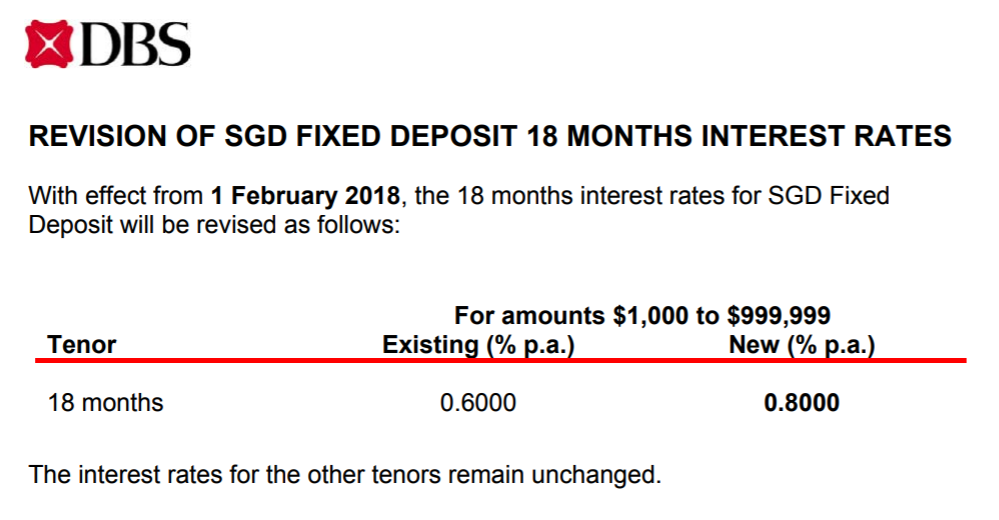

- Dbs Fixed Deposit Promotion - Find Coupon Codes (5 days ago) (2 days ago) maximum deposit amount of $75,000 and 3 to 18 months tenure DBS current highest fixed deposit rate is 0.60% p.a. For 8 months tenure with maximum deposit of $19,999. There is currently no.

- Set Up a Fixed Deposit Before Life Hands You Lemons No matter what plot twists life springs up, you’re empowered to overcome it calmer, smarter, better prepared. Your fixed deposit will act as a contingency fund i.e. A fund created to tackle emergencies and unforeseen developments, and should be equal to 3 to 6 months’ worth of your expenses.

Fixed Deposit or Singapore Savings Bonds?

Forget about the Singapore Savings Bonds. The 1 year interest rate for November 2020 Singapore Savings Bonds has fallen as low as 0.23%, thus any of the fixed deposits promotion below will beat the Singapore Savings Bonds.

The Alternatives – Short Term Endowments

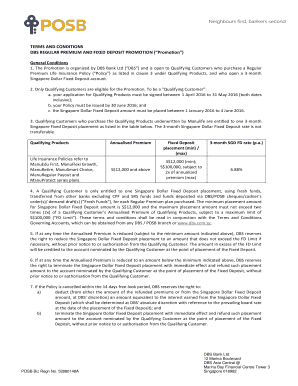

I have shared many other financial instruments that is similar to what fixed deposits can offer. One good alternative is buying a short term endowment plan. Endowment plans guarantee your capital upon maturity which is similar to what fixed deposits offer. Most of the short term endowment plans are on limited tranche basis.

At the point of writing, the second tranche of the popular NTUC Gro Capital Ease (1.96% for 3 years) is fully subscribed.

The Alternatives – GIGANTIC, Dash EasyEarn or Singlife

Alternatively, you can check out GIGANTIC, Dash EasyEarn or Singlife whereby there is no lock in period and they offer a higher returns as compared to fixed deposits. Personally, I have signed up a Singlife Account and Dash EasyEarn.

| GIGANTIC | Dash EasyEarn | Singlife Account | |

| Lock In Period | No | No | No |

| Minimum investment amount | S$50 | S$2,000 | S$500 |

| Return rate per annum | 2.0% per annum on your first S$10,000 for the first year 1.0% for amounts above S$10,000 for the first year | 2.0% p.a. return for the first year (Guaranteed 1.5% p.a. + 0.5% p.a. bonus for first policy year, available on a first come, first served basis) | 2.0% for first S$10,000 1.0% for next S$90,000 Note: * From 1 November 2020, customers who spend S$500 within their specified card spend period on the Singlife Visa Debit Card will qualify for a bonus 0.5% p.a. return on top of the new base return of 2% p.a. for the duration of one policy month. |

Nevertheless, if you still prefer traditional fixed deposits, below are the best fixed deposits promotion that I have found for October 2020. The current low interest rates offered by most banks remained unattractive to me.

Among the banks below, I prefer the fixed deposit from DBS given that DBS offer much higher interest rate per annum for a 12 month placement as compared to the rest of the banks. You will not find any banks except DBS that pays you 1.15% p.a. for a S$20,000 placement.

DBS is the best fixed deposits in October 2020!

DBS Fixed Deposit (Recommended)

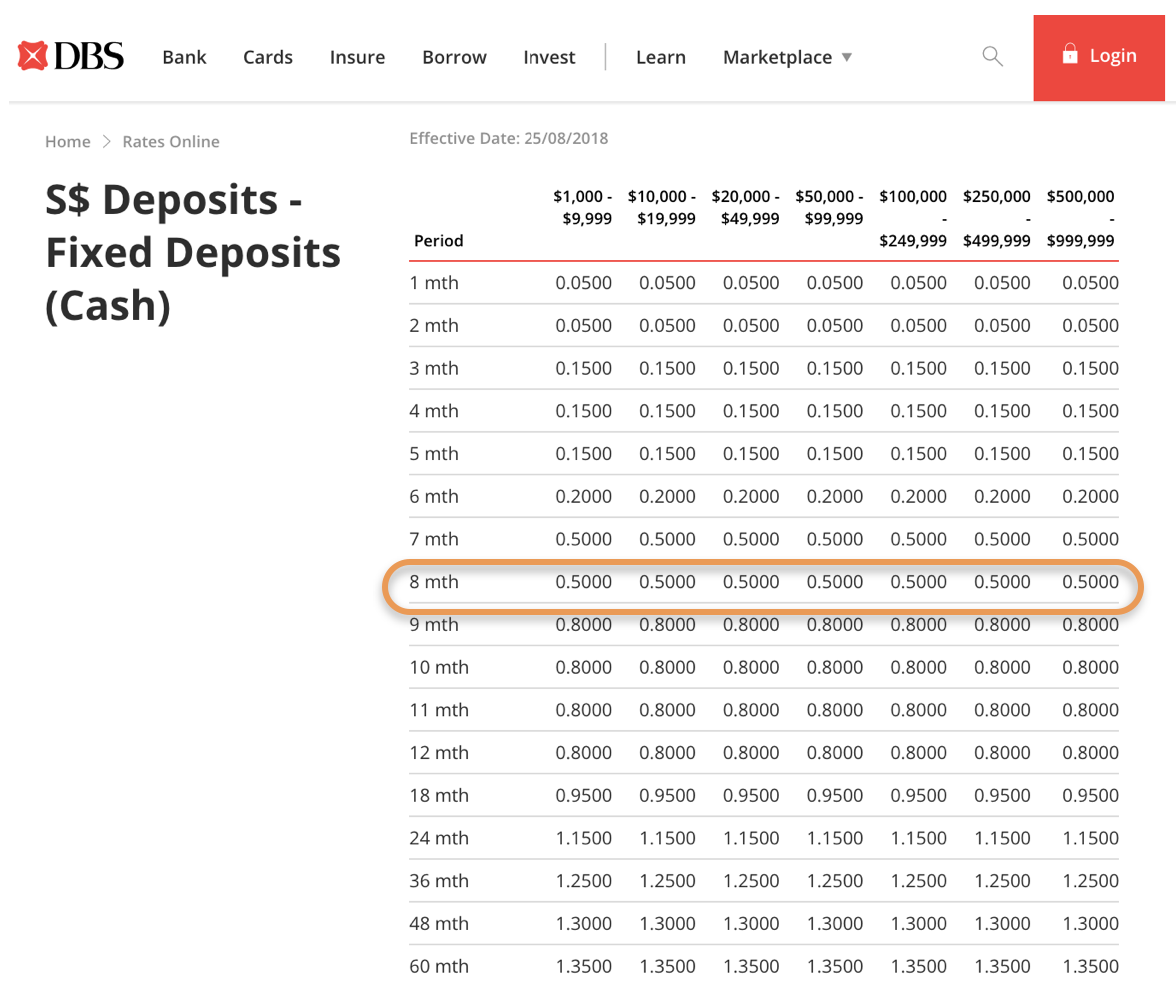

Interest Rate: Refer below, Minimum Placement: S$1,000, Promotion Valid Until: Not stated

The interests rates were published on 3rd September 2020. The interest rates for the amount tier S$1,000 to S$19,999 and other tenors remain unchanged. The interest rates for 12 months and above tenors are applicable only to rollover placements at the same tenors.

For a minimum amount of S$1,000, you can perform a fixed deposit placement with DBS. For a 12 months placement of S$10,000 at 1.15% p.a., the interest that you will receive upon maturity is S$115.

Hong Leong Finance Deposit Promotion

Interest Rate: Up to 0.85%, Minimum Placement: S$20,000, Promotion Valid Until: Not stated

For 12 months placement of S$20,000 at 0.85% p.a., the interest that you will receive upon maturity is S$170.00. This is on the condition that you perform the renewal or fresh funds deposit via PayNow.

| Deposit Amount | 12 months (Renewal or Fresh Funds via PayNow) | 12 months (Fresh Funds At Branch) |

| S$20,000 and above | 0.85% | 0.80% |

MayBank iSAVvy Time Deposit

Interest Rate: Refer below, Minimum Placement: S$5,000, Promotion Valid Until: Not stated

MayBank has reduced their interest rate across the tiers. Here are the interest rates for MayBank iSAVvy Time Deposit as of 9th October 2020.

For a 6 months placement of S$5,000 at 0.40% p.a., the interest that you will receive upon maturity is S$10.00.

For a 12 months placement of S$25,000 at 0.65% p.a. and 24 months at 0.85% p.a., the interest that you will receive upon maturity is S$162.50 and $426.81 respectively.

UOB Time Deposit

Interest Rate: 0.55%, Minimum Placement: S$20,000, Promotion Valid Until: 31st October 2020

The interest rate has fallen from 0.65% p.a. in September to 0.55% p.a. in October.

For 10 months placement of S$20,000 at 0.55% p.a., the interest that you will receive upon maturity is S$91.67.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$20,000 | 10 months | 0.55% p.a. |

OCBC Time Deposit

Interest Rate: 0.50%, Minimum Placement: S$5,000, Promotion Valid Until: 31st October 2020

OCBC has reduced their fixed deposit rate from 0.60% p.a. in September to 0.50% p.a. in October.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$5,000 | 12 months | 0.50% p.a. |

For 12 months placement of S$5,000 at 0.50% p.a., the interest that you will receive upon maturity is S$25.00.

CIMB Fixed Deposit

Interest Rate: Refer below, Minimum Placement: S$5,000, Promotion Valid Until: 31st October 2020

For 12 months placement of S$5,000 at 0.30% p.a., the interest that you will receive upon maturity is S$15.00.

Standard Chartered Bank Singapore Dollar Time Deposit

Interest Rate: 0.20% to 0.30%, Minimum Placement: S$25,000, Promotion Valid Until: 12th October 2020

For 6 months placement of S$25,000 at 0.20% p.a., the interest that you will receive upon maturity is S$25.00.

If you happen to be a priority banking customer, for 6 months placement of S$25,000 at 0.30% p.a., the interest that you will receive upon maturity is S$37.50.

| Minimum Placement | Tenure | Promotional Rate | Priority Banking Preferential Rate |

| S$25,000 | 6 months | 0.20% p.a. | 0.30% p.a. |

Looking for the best fixed deposits in Singapore? There are varying fixed deposit promotions in terms of interest rates, tenure period offered by the banks in June 2020.

The 1 year interest rate for July 2020 Singapore Savings Bonds has fallen as low as 0.30%, thus any of the fixed deposits promotion below will beat the Singapore Savings Bonds.

I have shared many other financial instruments that is similar to what fixed deposits can offer. They are endowment plans such as Tiq 3 Year Endowment Plan and China Taiping i-Save Plan. The benefit of these endowment plans is the guaranteed capital upon maturity which is similar to what fixed deposits offer.

Last month, I have signed up for a Singlife account, which is an insurance savings plan that offers you 2.5% p.a. for up to S$10,000. The interests paid last month was S$18.72 based on a deposit of S$10,000.

The current low interest rates offered by most banks remained unattractive to me. Nevertheless, if you still prefer traditional fixed deposits, below are the best fixed deposits promotion that I have found for June 2020. My preferred fixed deposits below is DBS and Maybank iSAVvy Time Deposit.

DBS Fixed Deposit

Interest Rate: Refer below, Minimum Placement: S$1,000, Promotion Valid Until: Not stated

Based on the interests rates published on 4th May 2020, the rates remained unchanged.

For a minimum amount of S$1,000, you can perform a fixed deposit placement with DBS. For a 12 months placement of S$10,000 at 1.40% p.a., the interest that you will receive upon maturity is S$140.

MayBank iSAVvy Time Deposit

Interest Rate: 1.20% (12 months) or 1.40% (24 months), Minimum Placement: S$25,000, Promotion Valid Until: Not stated

I found some changes to the time deposit offered by MayBank. It seems that MayBank had decided to do away with their traditional time deposit and replace with the iSAVvy Time Deposit.

This promotion is valid from 17th April 2020 onwards for a minimum placement amount of S$25,000 in iSAVvy Time Deposit via Maybank Mobile/Online Banking (for individuals only).

For a 12 months placement of S$25,000 at 1.20% p.a., the interest that you will receive upon maturity is S$300.

For a 24 months placement of S$25,000 at 1.40% p.a., the interest that you will receive upon maturity is S$704.90.

Hong Leong Finance Deposit Promotion

Interest Rate: Up to 0.95%, Minimum Placement: S$20,000, Promotion Valid Until: Not stated

For 10 months placement of S$20,000 at 0.90% p.a., the interest that you will receive upon maturity is S$150.00.

| Deposit Amount | 6 month | 10 month |

| S$20,000 to < S$100,000 | 0.55% | 0.90% |

| S$100,000 and above | 0.60% | 0.95% |

UOB Time Deposit

Interest Rate: 0.90%, Minimum Placement: S$20,000, Promotion Valid Until: 30th June 2020

Dbs Singapore Fixed Deposit Promotion

For 10 months placement of S$20,000 at 0.90% p.a., the interest that you will receive upon maturity is S$150.00.

Dbs Time Deposit Promotion

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$20,000 | 10 month | 0.90% p.a. |

OCBC Time Deposit

Interest Rate: 0.85%, Minimum Placement: S$5,000, Promotion Valid Until: 30th June 2020

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$5,000 | 12 month | 0.85% p.a. |

For 12 months placement of S$5,000 at 0.85% p.a., the interest that you will receive upon maturity is S$42.50.

Standard Chartered Bank Singapore Dollar Time Deposit

Interest Rate: 0.40% to 0.50%, Minimum Placement: S$25,000, Promotion Valid Until: 8th June 2020

For 6 months placement of S$25,000 at 0.40% p.a., the interest that you will receive upon maturity is S$50.

If you happen to be a priority banking customer, for 6 months placement of S$25,000 at 0.50% p.a., the interest that you will receive upon maturity is S$62.50.

| Minimum Placement | Tenure | Promotional Rate | Priority Banking Preferential Rate |

| S$25,000 | 6 months | 0.40% p.a. | 0.50% p.a. |